Welcome to

The BlackBay Group

At The BlackBay Group, our clients invest with confidence knowing their portfolios are guided by a time-tested market methodology first developed in the early 20th century by renowned market analyst Richard D. Wyckoff. Rather than reacting to short-term noise or emotion-driven trends, we base our investment decisions on principles that have endured across decades of market cycles.

About BlackBay Capital Advisors

BlackBay Capital Advisors, LLC offers investment advisory services which encompass various investment objectives from conservative to aggressive, allowing the client to define specific objectives that meet his/her personal investment goals.

Fiduciary Investment Management

Our firm was established to deliver structured, fiduciary investment management grounded in objective market analysis rather than prediction or speculation.

Wyckoff Method

We are guided by the Wyckoff Method, a time-tested framework for understanding market structure and price behavior.

Client-Defined Objectives

From conservative to aggressive strategies, we work with clients to define specific objectives that meet their personal investment goals.

Proven Track Record

Verified trading results spanning 40+ years across multiple asset classes. Real money competitions and audited returns.

Our Investment Philosophy

Process Over Prediction

Understanding Market Structure

Financial markets are complex systems shaped by liquidity, participant behavior, and changing supply-and-demand dynamics. Rather than relying on forecasts or narratives, our philosophy emphasizes understanding market structure and managing risk within that context.

Wyckoff Framework

Our investment framework is informed by Wyckoff market structure principles, a methodology developed to analyze how markets move through cycles of accumulation, expansion, distribution, and contraction.

What We Analyze

Rather than reacting to headlines or lagging indicators, we analyze: Supply and demand dynamics, Price and volume relationships, and Market phases and transitions. These principles help us understand where price is within its broader market cycle.

Risk-First Approach

We prioritize capital preservation and risk management before pursuing returns. Every investment decision begins with understanding and defining the downside, ensuring that portfolio exposure aligns with market conditions and client objectives.

Our Process

The Wyckoff Method is one of the most respected frameworks in technical market analysis, used by professional traders for over a century.

Core Wyckoff Principles

Supply and Demand

Price advances and declines reflect imbalances

Cause and Effect

Consolidation precedes expansion

Effort vs. Result

Volume reveals the quality of price movement

Composite Operator

Markets reflect the actions of professional capital

At BlackBay, we modernize these principles for today's markets — including digital assets — without diluting their integrity.

Risk Management Focus

Capital preservation is central to our process.

Position Sizing Discipline

Careful allocation of capital to manage exposure and protect against outsized losses.

Volatility Awareness

Understanding and adapting to changing market conditions and price fluctuations.

Drawdown Sensitivity

Monitoring and limiting portfolio declines to preserve capital during adverse conditions.

Dynamic Exposure Adjustment

Flexible positioning that responds to market structure and risk environment.

Returns are pursued only when risk is understood and defined.

Investment Services

Comprehensive portfolio management across traditional and digital assets

Investment Supervisory Service

We open client accounts in their name at the custodian such as Charles Schwab & Company, Inc. This allows us to do no-load mutual funds as well as discount stock commissions. You will also receive monthly statements, trade confirmations, and other communications regarding your account from the custodian.

All clients give us limited power-of-attorney, so we are able to execute trades on their behalf. Our trading and recommendations are in accordance with their Investment Policy and Objective Setting Questionnaire, which we complete for each individual client.

Download Agreement →Blended ETF Strategy

We open a client's accounts in their name at Charles Schwab & Company. You will receive monthly statements, trade confirmations, and other communications regarding your account from Charles Schwab. Charles Schwab will also email our clients every time a transaction has taken place in a client's account. This convenience allows clients to easily stay abreast of their account's performance.

All clients give us limited power-of-attorney, so we are able to execute trades on their behalf, as well as bill our fees. Our trading and recommendations are in accordance with their ETF Profile and Suitability Questionnaire, which we complete for each individual client.

Download Questionnaire →Blended Mutual Fund Strategy

We open client accounts in their name at the custodian of their choice. The custodians offer our clients taxable accounts, IRA accounts, as well as no-load annuities (which allow us numerous exchanges from their various mutual fund choices at no charge, as well as not generating a taxable event every time we do an exchange).

You will also receive monthly statements, trade confirmations, and other communications regarding your account from the custodian you have chosen. In most cases, the custodian even emails our clients every time a transaction has occurred in the client's account. All clients give us limited power-of-attorney, so we are able to execute trades on their behalf, as well as bill our fees. Our trading and recommendations are in accordance with their Mutual Fund Timing Profile and Suitability Questionnaire, which we complete for each individual client.

Download Questionnaire →Crypto Investment Supervisory

Client hereby retains the Adviser and the Adviser hereby agrees to provide investment management services with respect to certain assets of the Client (the "Portfolio") in accordance with the terms and conditions hereinafter set forth.

Throughout the term of this agreement, the Adviser shall only enter trades for client, as that is all a "Trading" API allows. Advisor does not have access to withdraw/transfer coins or monies from any exchange.

Download Agreement →Our Custodians

A financial custodian is a company that has physical possession of your financial assets. It's often a brokerage, commercial bank, or other type of institution that holds your money and investments for convenience and security.

Charles Schwab

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries.

Visit Schwab →

Interactive Brokers

Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds.

Visit Interactive Brokers →

ProFunds

ProFunds provides a wide range of investment strategies designed to help investors express their market views with precision and flexibility.

Visit ProFunds →

Guggenheim (Rydex)

For more than 20 years, investors have relied on Rydex to help express their market conviction using innovative beta allocations and tactical strategies.

Visit Rydex →Leadership

Todd W. Butterfield

Todd W. Butterfield is President and Chief Investment Strategist of BlackBay Capital Advisors, LLC, where he is responsible for overseeing investment philosophy, market analysis, and strategic portfolio direction. With more than four decades of experience across multiple market cycles, Mr. Butterfield brings a disciplined, process-driven approach to capital management grounded in market structure and risk awareness.

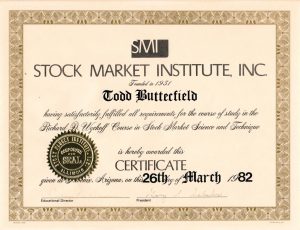

Mr. Butterfield's investment foundation is rooted in the Wyckoff Method, a market structure framework focused on price, volume, and supply-and-demand dynamics. He graduated from the Wyckoff Stock Market Institute in 1982 and has applied Wyckoff principles throughout his professional career in both advisory and active market environments.

He began his career in 1984 as a professional trader in equities, options, and commodities with Rialcor Shatkin in Chicago. In 1990, Mr. Butterfield registered as a Commodity Trading Advisor, developing a multi-year track record during a period of heightened market volatility. In 1991, he transitioned into a client-facing advisory role as a Financial Consultant with Smith Barney in Quincy, Illinois.

In 1997, Mr. Butterfield founded Butterfield Capital Advisors and Butterfield Futures, expanding his ability to provide fee-based investment advice as a Registered Investment Adviser while also offering futures brokerage services as an Introducing Broker. This dual perspective further shaped his emphasis on risk management, position sizing, and disciplined decision-making.

In 2011, he formed The BlackBay Group, which includes BlackBay Capital Advisors, LLC. The firm was established to deliver structured, fiduciary investment management grounded in objective market analysis rather than prediction or speculation.

In 2016, Mr. Butterfield assumed leadership of the Wyckoff Stock Market Institute and relaunched WyckoffSMI.com, preserving and modernizing the original Wyckoff curriculum for contemporary markets. Beginning in 2017, he expanded his market focus to include digital assets, applying Wyckoff market structure principles to cryptocurrency markets alongside traditional asset classes.

In 2022, Mr. Butterfield launched WyckoffSMIChina.com to support a growing international community of students and professionals seeking structured market education.

Mr. Butterfield's work reflects a consistent philosophy: markets operate in discernible cycles, risk must be managed before returns are pursued, and disciplined processes outperform emotional decision-making over time. These principles guide his leadership at BlackBay Capital Advisors and inform the firm's fiduciary approach to client capital.

Karrie Butterfield

Mrs. Butterfield has been with The BlackBay Group since inception.

Proven Track Record

Verified competition results and audited returns spanning 40+ years

Select any milestone to view verified competition results and audited performance records.

Wyckoff Certificate — 1982

Graduated from the Wyckoff Stock Market Institute, establishing the foundation for a disciplined, structure-based approach to market analysis that has guided investment decisions for over 40 years.

1984 U.S. Investment Championship

"12th in the Nation", 31.9% (Feb 1-June 1), 85 Entrants, Futures Division, U.S. Investment Championship, 1984.

Below is the actual trade sheet from the competition.

View Barron's Rankings →1987-1990: 79.8% Annual Return Commodity Trading Advisor

Todd achieved a 79.8% average annual return, Commodity Trading Advisor 1987-1990

View Disclosure Document →1992 U.S. Investment Championship

In 1992, Todd Butterfield placed 9th in the U.S. Investment Championship $50,000+ "Stock Division" & 17th in the "Mutual Fund Switching Division".

View Barron's Rankings →1993 Money Manager Verified Ratings

In 1993, Todd placed 4th in the Money Manager Verified Ratings "Low Risk Division" with a 28.1% return. ($1 Million-Plus Portfolio)

View Barron's Rankings →2012 BlackBay Blended Investment Strategy 34.71% Auditors Report

11/30/2011 – 12/31/2011 : .32%

12/31/2011 – 12/31/2012 : 34.71%

12/31/12 – 7/31/2013 : 9.83%

FAQ

Contact Us

Thank you for visiting The BlackBay Group! If you have questions or would like to contact us regarding opening your own investment account please use the contact form located on this page.

Need help? Get answers to any of your questions and help from our support team.

Office Locations

Main Office

316 E. 1150th St.

Payson, Illinois 62360

Trading Office

1511 Locust

St. Louis, Missouri 63103

Get In Touch

This communication is not an offer to sell or a solicitation of an offer to buy securities.