Welcome to The BlackBay Group

Clients of The BlackBay group are able to invest comfortably knowing that all decisions regarding their financial investments are being made based on profitable investment strategies dating back to the 1920’s from world renowned Richard D. Wyckoff.

BlackBay Capital Advisors

BlackBay Capital Advisors, LLC offers investment advisory services which encompass various investment objectives from conservative to aggressive, allowing the client to define specific objectives that meet his/her personal investment goals

OUR CUSTODIANS

A financial custodian is a company that has physical possession of your financial

assets. It’s often a brokerage, commercial bank, or other type of institution that

holds your money and investments for convenience and security.

Charles Schwab

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services

Rydex

For more than 20 years, investors have relied on us to help express their market conviction using such innovative beta allocations.

We offer two distinct services to our clients

- Investment Supervisory Service: In discussions with the client, we establish certain investment goals consistent with the client’s personal situation and with his/her tolerance for risk. We then construct an appropriate portfolio, and monitor that portfolio on a continual basis. That portfolio can consist of stocks, bonds, mutual funds, ETF's, and Cryptocurrency.

- Blended Strategy - Mutual Fund/ETF Investment services: BlackBay Capital Advisors employs a market timing strategy for Mutual Funds/ETF’s using strict technical market analysis as taught by the Wyckoff Principles. Our goal is to produce long-term competitive results with a reduction in both risk and downside market volatility.

INVESTMENT SUPERVISORY SERVICE

We open client accounts in their name at the custodian such as Charles Schwab & Company, Inc.. This allows us to do no-load mutual funds as well as discount stock commissions. You will also receive monthly statements, trade confirmations, and other communications regarding your account from the custodian. All clients give us limited power-of-attorney, so we are able to execute trades on their behalf. Our trading and recommendations are in accordance with their Investment Policy and Objective Setting Questionnaire, which we complete for each individual client.

BLENDED ETF STRATEGY

We open a client’s accounts in their name at Charles Schwab & Company. You will receive monthly statements, trade confirmations, and other communications regarding your account from Charles Schwab. Charles Schwab will also email our clients, every time a transaction has taken place in a clients account. This convenience allows clients to easily stay abreast of their accounts performance. All clients give us limited power-of-attorney, so we are able to execute trades on their behalf, as well as bill our fees. Our trading and recommendations are in accordance with their ETF Profile and Suitability Questionnaire, which we complete for each individual client.

BLENDED MUTUAL FUND STRATEGY

We open client accounts in their name at the custodian of their choice. The custodians offer our clients taxable accounts, IRA accounts, as well as no-load annuities (which allow us numerous exchanges from their various mutual fund choices at no charge, as well as not generating a taxable event every time we do an exchange). You will also receive monthly statements, trade confirmations, and other communications regarding your account from the custodian you have chosen. In most cases, the custodian even emails our clients, every time a transaction has occurred in the clients account. This convenience allows clients to easily stay abreast of their accounts performance. All clients give us limited power-of-attorney, so we are able to execute trades on their behalf, as well as bill our fees. Our trading and recommendations are in accordance with their Mutual Fund Timing Profile and Suitability Questionnaire, which we complete for each individual client.

CRYPTO INVESTMENT SUPERVISORY

Client hereby retains the Adviser and the Adviser hereby agrees to provide investment management services with respect to certain assets of the Client (the “Portfolio”) in accordance with the terms and conditions hereinafter set forth. Throughout the term of this agreement, the Adviser shall only enter trades for client, as that is all a “Trading” API allows. Advisor does not have access to withdraw/transfer coins or monies from any exchange.

About BlackBay Group President

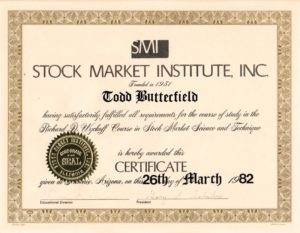

Todd W. Butterfield President | Chief Strategist Wyckoff Stock Market Institute

In 1982, Mr. Butterfield graduated from the Wyckoff Stock Market Institute and was anxious to put his knowledge to the test. Mr. Butterfield decided to enter the U.S. Investment Championship’s real money competitions to prove that he was able to compete. The first one he entered he placed 12th in the nation, and every competition he entered over the years has been listed below. Mr. Butterfield began his professional career in 1984, as a Professional Stock, Option, and Commodity Trader with Rialcor Shatkin, Chicago, Illinois. In 1990, he registered as a Commodity Trading Advisor with a very successful 4 year track record. In 1991, he became a Financial Consultant for Smith Barney, Quincy, Illinois. At the beginning of 1997, Mr. Butterfield founded Butterfield Capital Advisors/Butterfield Futures. As a Registered Investment Advisor, he could offer fee-based investment advice to his clients, and as an IB he could offer futures brokerage services. In 2011, he formed The BlackBay Group, which encompasses BlackBay Capital Advisors (RIA). In 2016, took over the Wyckoff Stock Market Institute, and relaunched WyckoffSMI.com. In 2017, started actively trading/managing assets in the cryptocurrency space, as well as launching LearnCrypto.io. In March of 2022, launched WyckoffSMIChina.com to better support their China students/members.

Click on each yearly tab below to see results of every real-money competition that Mr. Butterfield entered.

“12th in the Nation”, 31.9% (Feb 1-June 1), 85 Entrants, Futures Division, U.S. Investment Championship, 1984. Below is the actual trade sheet from the competition. Click here to view Barrons rankings.

Todd achieved a 79.8% average annual return, Commodity Trading Advisor 1987-1990 Click here to view Disclosure Document

In 1992, Todd Butterfield placed 9th in the U.S. Investment Championship $50,000+ “Stock Division” & 17th in the “Mutual Fund Switching Division”. Click here to view Barron’s rankings.

In 1993, Todd placed 4th in the Money Manager Verified Ratings “Low Risk Division” with a 28.1% return. ($1 Million-Plus Portfolio) Click here to view Barrons rankings

11/30/2011 – 12/31/2011 : .32%

12/31/2011 – 12/31/2012 : 34.71%

12/31/12 – 7/31/2013 : 9.83%

Contact us today to get started...!

Get answer to common questions about The BlackBay Group

$0 commission on online trades.

No we do not, as all assets are held by Charles Schwab, Profunds, or Guggenheim.

It has been shown that adding a small weighting of let’s say 1-3% could have dramatically helped your overall portfolio risk/reward.

No, we only have access through a trading API, so we can only trade/view/manage.

When paying fees instead of commissions, you can rest assured that the advice you are getting is in your best interest. You and your advisor are on the same side of the table.

To Learn About Cryptocurrencies feel free to go to LearnCrypto.io

The BlackBay Group

BlackBay Capital Advisors is a State Registered Investment Advisor